Water damage claims are among the most dynamic and complex property claims insurers face. While most of the focus tends to be on the damage itself, a major driver of claim trajectory lies in how it is initially lodged. This early moment can set a claim up for smooth resolution—or a cascade of complications.

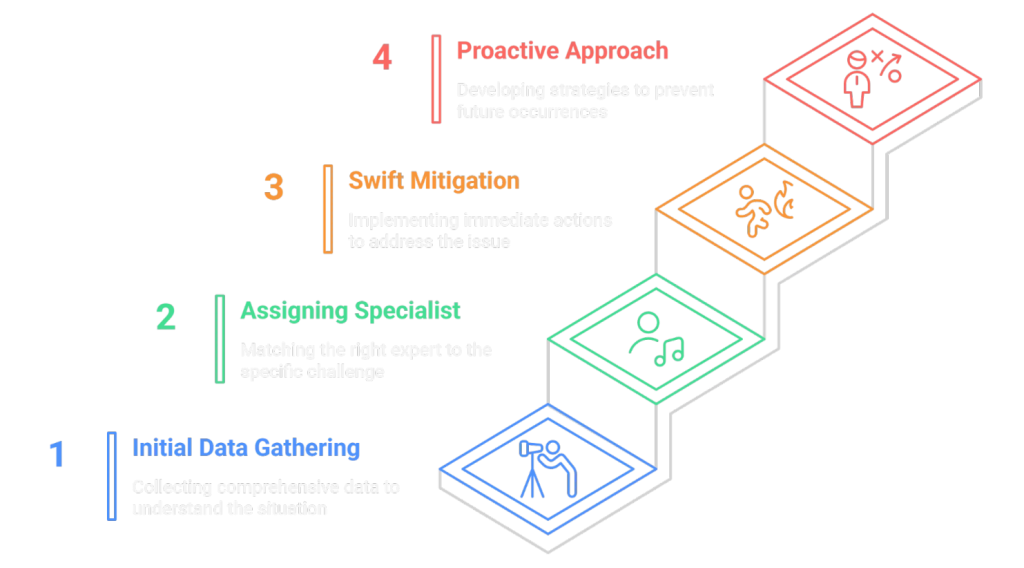

The Power of Initial Data Gathering

The first step in shaping a water damage claim outcome lies in the intake process. It’s not enough to collect basic information like time, location, and a brief room description. Without asking the right questions, insurers risk missing critical details. For example, is the water clean or contaminated? Is it affecting structural elements? Has it been sitting for hours or was it just discovered?

Failing to gather these specifics leads to blind spots in decision-making. One of the most common consequences is mis-assigning the first responder, which can delay mitigation and allow the damage to escalate significantly.

Assigning the Right Specialist, First Time

The data collected at lodgement should directly inform which specialist is deployed first. Depending on the scenario, a mitigation technician may be urgently needed, or it may be more appropriate to assign a builder for structural concerns. Unfortunately, many insurers still rely on generic or static assignment models that don’t account for nuance or urgency.

Developing a specialist response matrix can change this. By understanding the unique strengths of different vendors—such as a mitigation team that can be onsite within four hours versus a builder better suited for structural make-safes—insurers can match the right resource to the right scenario every time.

Swift Mitigation Is Critical

Water damage doesn’t wait. It spreads and causes secondary damage rapidly. Traditional claims handling models often treat property damage as static, leading to dangerous delays. Training and process design must acknowledge that water claims are time-sensitive and require early intervention.

The earlier mitigation begins, the more damage can be prevented. A lag in response—even just a few hours—can mean the difference between a simple clean-up and a full-scale repair job.

Turning Reactive into Proactive

Insurers can transform water damage claims handling by improving three key areas:

- Intake protocols that prompt better questioning and deeper data capture

- Specialist matching based on situation-specific needs

- Prioritising immediate mitigation to limit damage spread

Ultimately, the most significant leverage point in a water damage claim is at the moment of lodgement. By making smarter, faster decisions upfront, insurers shift from reactive management to proactive prevention—resulting in better outcomes for both the insurer and the policyholder.