Water damage claims are becoming increasingly costly, and insurers are under pressure to manage these rising expenses more effectively. Traditionally, the response has followed one of two paths—both of which come with significant challenges. Here’s a breakdown of the current issues and a forward-looking solution to reclaim control and reduce long-term costs.

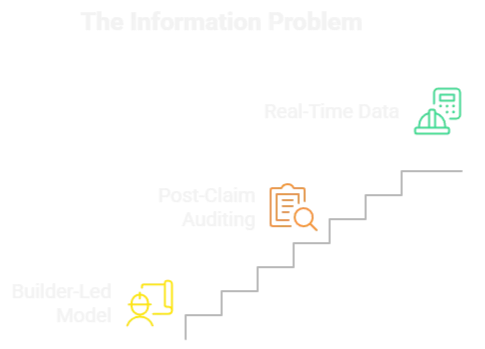

The Builder-Led Model: A Double-Edged Sword

Many insurers have turned to a Builder-Led Model, outsourcing the entire claims process to general contractors. Under this model, the builder manages everything from the initial emergency response to coordinating all trades and water mitigation.

However, this seemingly efficient method creates two key problems:

1. The Timeline Problem

Builders often delay action due to layered scheduling. Project managers are appointed first, who then engage mitigation specialists. In water damage cases, time is critical—every 6 to 12 hours of delay can exponentially worsen damage. Delays increase the risk of structural compromise and mould development, leading to much higher repair costs.

2. The Incentives Problem

Builders are incentivised to scope out full repairs and reconstructions rather than minimizing damage. As an insurer, your first line of defence should be incentivised to preserve or protect building structures from damage or deterioration not a business model that is very efficient and scoping the full repair, reconstruction and replacement.

Another approach is desktop auditing after the claim is closed, which seeks to identify inflated costs or unnecessary work. But this method suffers from fundamental flaws:

- Lack of On-Site Context: Reviewers never see the real site conditions that shaped decisions, leading to assumptions based on incomplete information.

- Missing Environmental Data: Critical moisture readings, drying progress, and equipment use details are not captured in real time and are lost by the time of review.

- Ignored Timeline Factors: Timing-related aspects like delayed response, weekend work, or equipment pickup delays vanish from the record, though they greatly affect cost.

- No Opportunity for Correction: Once discovered, any issues are already baked into the cost. Attempts to dispute them only add audit fees to already inflated expenses.

A Smarter Way Forward: Real-Time Data at the Source

The solution lies in real-time, structured data collection from the claim site. Progressive insurers are moving toward standardised data frameworks that equip on-site contractors to record critical information consistently from day one.

Benefits of Structured Data Collection:

- Immediate Insight: Enables insurers to flag issues and intervene early—before costs spiral.

- Standardised Reporting: Eliminates guesswork and inconsistent narratives.

- Predictable Costing: Builds a database that improves forecasting and claims efficiency over time.

Reclaiming Control in the Claims Process

By adopting real-time data frameworks, insurers shift the information flow back in their favour. Rather than being sidelined by contractors and slow audits, claims teams can become the central command hub, making informed, timely decisions.

This isn’t just a tactic for cost control—it’s a strategy for leadership. Insurers who harness data from the ground up will outperform those who continue to react from a distance. The future belongs to insurers who bring intelligence closer, not outsource it further away.