In the aftermath of a property loss, insurers have a unique opportunity to provide meaningful support to their customers. This involves addressing three critical elements: protecting the asset, maintaining the insured’s mental and emotional wellbeing, and fostering integrated stakeholder relationships. By focusing on these principles from the outset of a claim, insurers can become a net positive force for affected households and communities.

The Importance of Day 0 in Claims Management

The initial stages of a property claim, particularly for water damage, set the tone for the entire process. Decisions made at “Day 0” have a ripple effect on cost, trust, and outcomes. Delays or inefficiencies can result in escalated costs and prolonged stress for the insured. With Australian insurers collectively spending hundreds of millions annually on water damage repairs, prioritizing a swift and structured response is crucial.

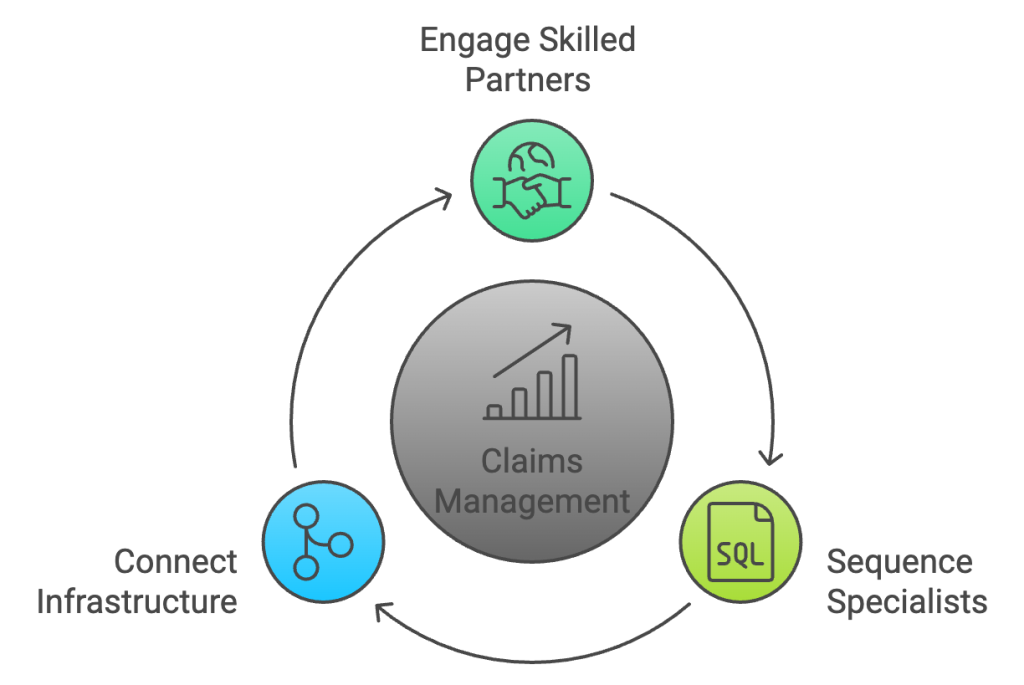

Three Key Principles for Effective Claims Management

1. Capable and Highly Skilled Service Partners

Engaging the right service providers from the start is essential. For instance, water damage requires niche expertise to mitigate losses within the critical first 24 hours. Without timely intervention, the damage spreads, and costs rise exponentially. Insurers must avoid relying on general repair teams who might outsource mitigation tasks, inadvertently prolonging the damage.

2. Sequencing the Right Specialist at the Right Time

Timing is everything when responding to property loss. Deploying specialists—such as water damage mitigation teams—at the correct stage ensures the insured’s assets and wellbeing are protected. Missteps in sequencing can lead to unnecessary delays, higher costs, and secondary consequences for the affected property and its occupants.

3. Connective Infrastructure to Minimise Friction

Claims management workflows should be seamless, with minimal bottlenecks. This requires robust connective infrastructure, including technology that enables clear communication and process tracking. Human understanding of the technology is equally critical to ensure smooth execution. Properly structured workflows promote continuity and reduce delays, fostering trust between all parties.

Laying the Groundwork for Success

By aligning claims response strategies with these principles, insurers can establish a strong foundation for successful outcomes. Engaging skilled service partners, sequencing specialists effectively, and minimising friction through infrastructure improvements help ensure that claims progress efficiently. This approach strengthens trust between the insured and the insurer’s brand while mitigating the turmoil of loss events.

As claims professionals, our mission is to support families in returning to their homes, businesses resuming operations, and communities recovering quickly. By focusing on the fundamentals at Day 0, insurers can create lasting positive impacts.