A recent conversation with a claims manager highlighted a troubling trend—an unexpected spike in costs across certain claims. Despite assessing similar property loss elements, the underlying reasons for cost escalation remained unclear. Upon closer examination, these claims had reached an inflection point, where costs, timeframes, and project dynamics compounded rapidly.

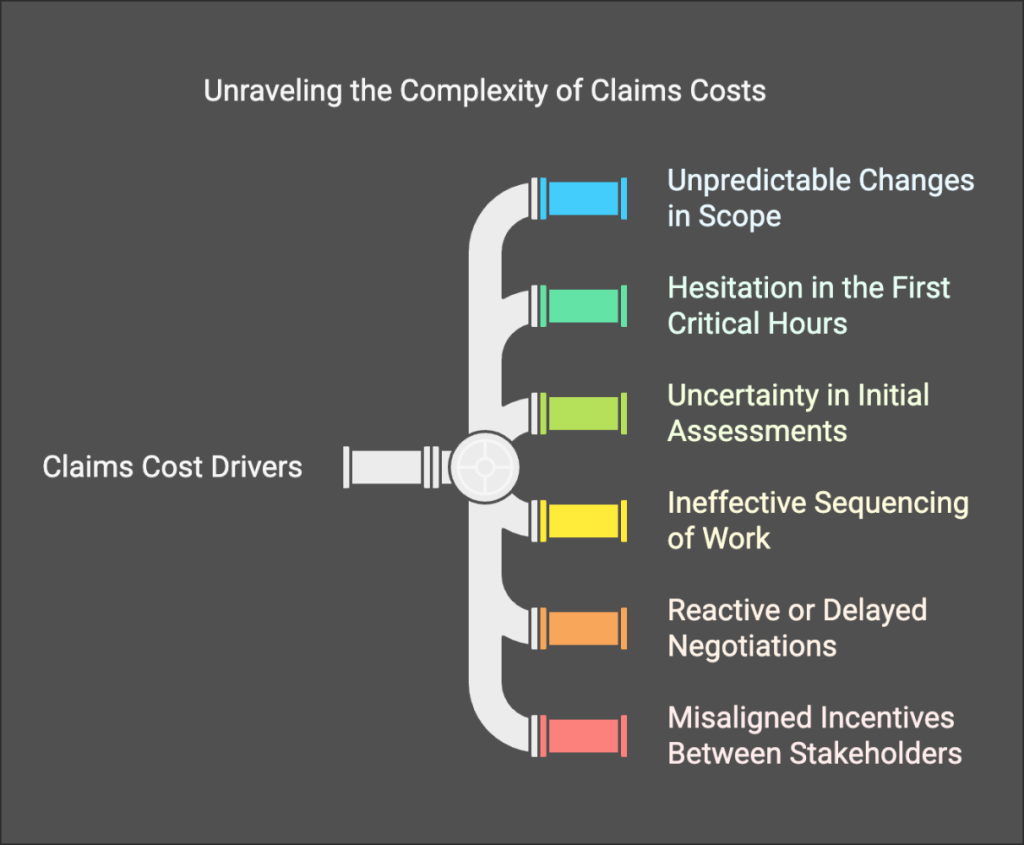

By breaking down the issue from first principles, we can identify six core reasons why claims costs spiral out of control—and how to prevent them.

1. Unpredictable Changes in Scope

Property loss projects often evolve due to unforeseen complications, such as hidden mould growth discovered during strip-out stages. If these risks are not accounted for in the initial assessment, remediation costs can significantly rise.

A structured review process at key milestones helps teams reassess scope, costs, and risks. By defining project stages and conducting timely evaluations, stakeholders can adapt early, minimizing surprises and ensuring smoother claims resolution.

2. Hesitation in the First Critical Hours

The initial 48–72 hours following an incident are crucial. Delays in claim lodgement, assessor visits, or emergency response often exacerbate damages. For instance, in a recent water loss case, a four-day delay allowed moisture to spread across multiple rooms, significantly increasing structural repair costs.

Swift action within this critical window—by insurers, adjusters, or mitigation teams—can prevent further deterioration. Implementing first-response protocols ensures a proactive rather than reactive approach, containing escalation early.

3. Uncertainty in Initial Assessments

Incomplete or vague initial assessments create ambiguity, leading to stalled decision-making and reactive adjustments. Reports must clearly define damage scope and necessary mitigation measures to provide a definitive path forward.

Incorporating both broad and specific details in assessments eliminates uncertainty. Accurate data supports confident decision-making, reducing project delays and cost escalations.

4. Ineffective Sequencing of Work

Claims escalate when service providers are engaged at the wrong time or when their objectives are misaligned. Effective sequencing ensures mitigation teams, builders, engineers, and hygienists arrive at the appropriate project stage with a shared goal.

Establishing a project roadmap and clear communication early in the claim process prevents missteps, improving efficiency and reducing unnecessary costs.

5. Reactive or Delayed Negotiations

Cost spikes often occur when discussions around large-loss cost structures happen too late. For example, prolonged use of dehumidification equipment can drive costs higher while engineers assess site conditions. If negotiation occurs post-project, opportunities for cost control diminish.

Functional relationships between insurers and service providers should include proactive discussions throughout the project. Real-time collaboration fosters alignment, trust, and strategic cost management.

6. Misaligned Incentives Between Stakeholders

For optimal outcomes, insurers and service providers must work toward a mutually beneficial objective. Transparency is crucial—without it, ambiguity and misalignment result in inefficiencies.

By fostering clear communication and shared goals, both parties can drive better results. Future discussions will explore insurer-service provider incentives and how alignment enhances claims efficiency.

Insurers can take several practical steps to control claims cost escalation:

- Manage project scope to anticipate unpredictable changes.

- Act swiftly in the initial hours to prevent deterioration.

- Ensure clarity in initial assessments to eliminate uncertainty.

- Sequence service providers effectively to enhance efficiency.

- Engage in proactive cost negotiations to prevent excessive expenditures.

- Foster transparency to align stakeholder incentives.

Stay tuned for further videos & articles, where we delve deeper into service provider and insurer dynamics and their impact on property claims outcomes.